On pursuing financial freedom I have changed this particular mindset about savings.

Intro: I am a personal finance advocate for minimum wage earner and I am on my quest to get a hold of Financial Freedom.

They say in able to achieve Financial Freedom one must learn how to make “money work for you”.

By the way, I am currently employed earning a bit over minimum wage but I have been on a couple of jobs before which pays exactly minimum wage plus tax, so I know what it is like to live within my means.

I am trying out some investment platform in which fulfils the saying “make your money work for you”, currently I am into PSE Philippine Stock Market.

I am no way endorsing anyone to try out the Stock Market I am just here to tell my own story if I will be profitable in this endeavour or not.

And by the way, the stock market is not the only way to be financially free. It can be anything, maybe business (not a passive income but a good way to accumulate wealth) or what’s more popular nowadays which is Youtube earning money thru advertisement and all other things.

The plan is to accumulate as much as passive income as I can until it is enough to cover my daily expenses and wants.

Why savings is not enough?

By the way, I actually learn this from social media. There are a lot of pages out there that would tell you that savings are actually meant losing money.

I also read about it on Roberto Kiyosaki’s book as well.

If you keep money in the bank with 1% interest rate, in a year that will all be eaten up by the inflation rate let us say about 6-7% especially here in the Philippines.

Tired of Saving

Saving is important and I salute the social media community for reiterating that too many of our Filipino folks like Peso Sense.

But what happens after savings?

That is the question I think I need to address.

If my goal is to buy new shoes, an appliance for my mom’s home or for my travel out of town saving will definitely serve its purpose.

But if your goal is to be financially free.

Saving alone cannot do that.

Saw this post over social media and it makes a lot of sense.

This example is totally true and it makes a lot of sense not to save rather invest.

I’ve been saving a lot back in the days but I always felt exhausted. After laborious budgeting and living within my means for a long period of time my savings is still not enough for me to be financially free.

Thankfully, now, I know the reason why.

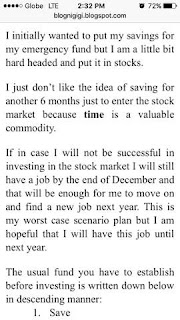

I have this post on my blog back then and this reflects my exhaustion to savings.

Savings is one Step to be Financially Free

My game plan to be financially free is to find as many passive incomes as possible until it comes to the time it will be enough to cover my daily expense and wants.

I personally use my savings to invest in the stock market which in turn yield more money for me (with the right stock pick of course, I think Jollibee JFC is a good pick because it has been consistent uptrend for the past years, this is not a stock recommedation).

Importance of Savings

I know a lot of financial advocates reiterate the importance of emergency fund and this is no brainer, it is indeed important to have cash on hand in case a need arises.

I do not know if my choice is right to put my savings directly to the stock market rather than keep it in the bank.

But for now, I am blessed not to have an emergency.

As of the moment I consistently pay myself first every payday and put it on the stock market (you can put money on other investment platform, it doesn't have to be just the Philippine Stock Market)

Yes, I am still saving, please don't get me wrong with this post but I try to put everything to investments that will yield more money.

As of the moment I consistently pay myself first every payday and put it on the stock market (you can put money on other investment platform, it doesn't have to be just the Philippine Stock Market)

Yes, I am still saving, please don't get me wrong with this post but I try to put everything to investments that will yield more money.

I recently love this post from Mr Pol, credits to his post.

Final Thoughts

I think that everyone has a goal financially and I am not in the position to tell you what to do with savings, if this is right or this is wrong.

Nevertheless, I hope you get my two cents on handling my financial goals.

That is it for now.

Thanks for reading all the way!

No comments:

Post a Comment

Would love to hear and interact with my readers.